Trade Finance Approval Workflow

Why automate?

How Cflow Can Help Automate the Process:

Centralized Documentation and Submission:

Cflow provides a centralized platform for submitting and documenting trade finance requests. It captures all the necessary details such as trade items and financial information accurately to ensure consistent data is stored. This simplest the approval process that improves data integrity.

Automated Credit and Risk Assessment:

Cflow enables automatic verification of the creditworthiness of eligible trading partners by analyzing risks and points out any discrepancies for further review by relevant members. This ensures accurate risk assessment and maintains compliance with the financial regulations.

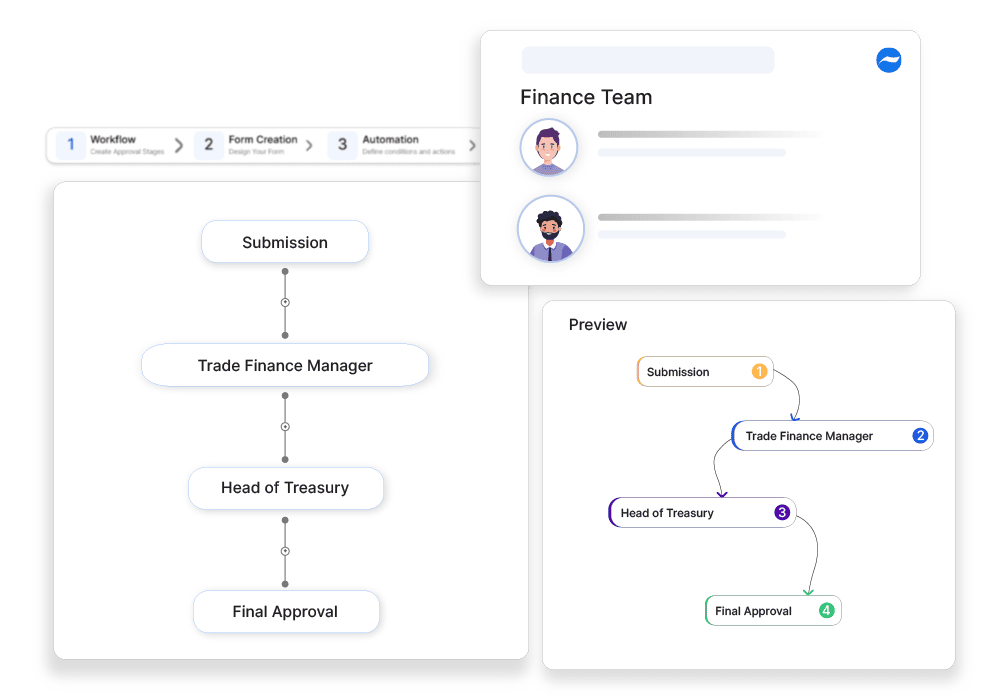

Streamlined Approval Workflows:

Cflow offers a pre-defined approval workflow through which the trade finance requests are routed to the relevant approvers. This is done to facilitate a thorough review possess to ensure there are no delays in the approval and to facilitate smooth international transactions.

Detailed Reporting and Compliance Tracking:

With Cflow users can get detailed reports and monitor compliance regulations easily. The report includes information on credit assessments, approval histories, and compliance checks. This improves visibility and provides better insight into international trade activities and mitigating risks on time.

Frequently Asked Questions

What are common trade finance instruments?

Letters of credit, export credit insurance, and trade loans.

How does trade finance help businesses?

It facilitates international trade by mitigating payment risks.

What compliance issues are associated with trade finance?

Anti-money laundering (AML) and Know Your Customer (KYC) regulations.