Loan Payment Approval Workflow

Why automate?

How Cflow Can Help Automate the Process:

Centralized Payment Documentation:

Cflow allows for the centralized documentation and submission of loan payments, ensuring that all necessary details, such as payment amounts and due dates, are accurately captured. This standardization simplifies the approval process and reduces administrative effort.

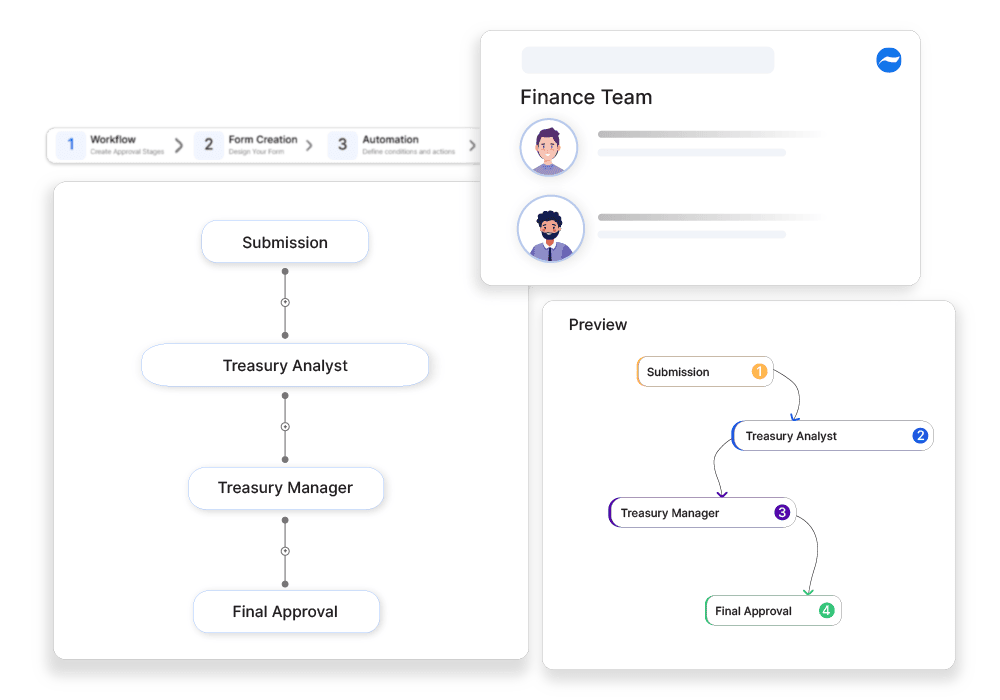

Streamlined Approval Workflows:

Loan payment proposals are routed through a predefined approval workflow, involving relevant finance and management teams. This ensures thorough review and timely authorization of payments.

Detailed Reporting and Payment Tracking:

Cflow provides detailed reports on loan payment approvals, including payment schedules, approval statuses, and compliance checks. This transparency supports better debt management and financial planning, providing insights into the organization’s debt obligations and payment history.

Automated Compliance Verification:

Automated workflows can verify loan payments against loan agreements and check compliance with loan terms quickly and efficiently. Cflow ensures that all loan payments are accurate and are as per contractual obligations.

Frequently Asked Questions

What documents are needed for loan payment approvals?

Required documents include loan agreements, repayment schedules, interest statements, and financial statements.

Can loan payments be deferred or restructured?

Yes, subject to lender approval, financial hardship conditions, or renegotiation terms.

What are the consequences of delayed loan payments?

Late payments can lead to penalties, higher interest rates, and negative credit impacts.